Release

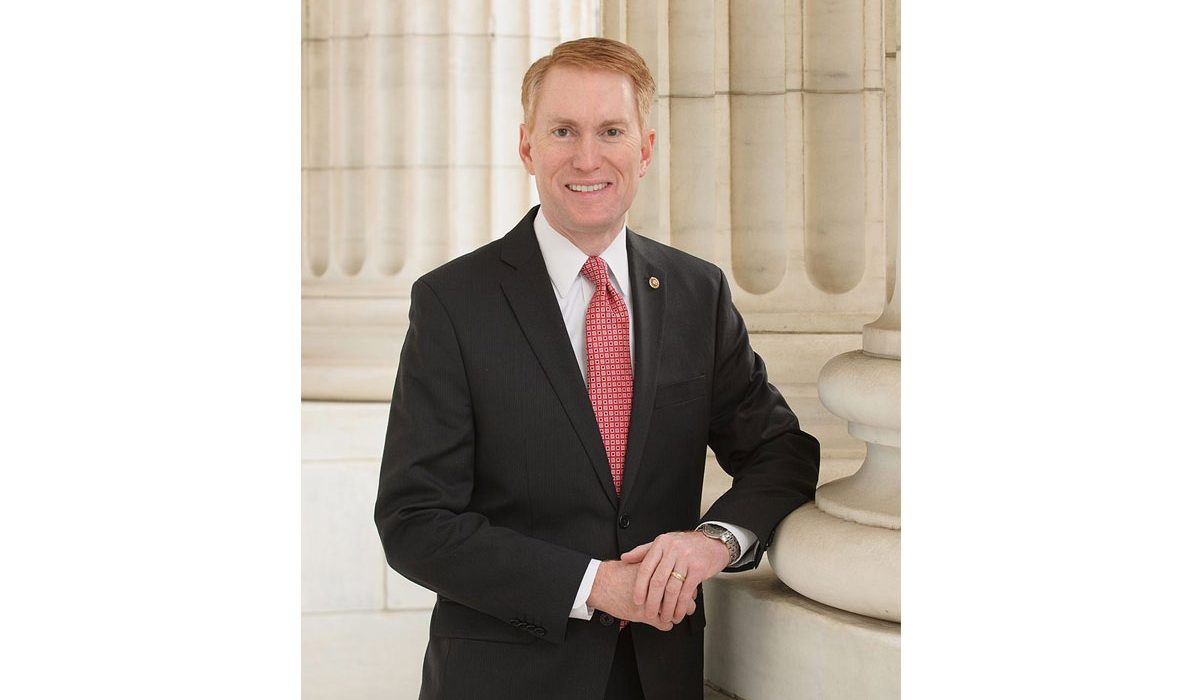

WASHINGTON, DC – Senator James Lankford (R-OK) today voted to oppose a Senate Democrat-backed resolution that would undo a $10,000 cap on state and local taxes (SALT) deduction. Lankford’s vote to oppose the Resolution of Disapproval effectively blocks removing a cap on the SALT deduction put in place by the Tax Cuts and Jobs Act of 2017.

“Repealing the state and local taxes cap will force taxpayers living in middle America to subsidize those living in high tax states and localities,” Lankford said. “This only serves to provide a tax break for some of the wealthiest taxpayers, given that 94 percent of the taxpayers who will benefit from the repeal of the SALT cap make over $200,000 a year. Oklahomans should not be asked to pay for the tax bills of those choosing to live in high-cost, high-tax areas.

“The Tax Cuts and Jobs Act has grown our economy, demonstrated wages are up, unemployment is down, and business investment has increased. Repealing the SALT cap will only worsen our ever-growing deficit problem, and benefit wealthy taxpayers at the expense of hardworking middle-class families and Oklahomans.”

The Congressional Review Act (CRA) permits Congress to overturn an agency rule with a simple majority vote within 60 legislative days after an agency has submitted the rule to Congress. For the resolution to take effect, it must pass both the Senate and House and be signed into law by the President.

Lankford is a member of the Senate Committee on Finance and the Senate Committee on Appropriations.